The Rise and Fall of FTX – Part Three

FTX's presidential tokens, FTX.US, Serum, Blockfolio, and Alameda's risky bets in 2020.

Hello folks!

We’re back at it again with Part Three of this freak show ;)

BTW - we run a content agency called Quill. If you’re interested in leveraging written content like this for organic growth in your own business, hit us up here:

Part Two in case you missed it.

Disclaimer: Throughout the course of research on FTX, we’ve encountered various conflicting claims on major events. Even SBF himself uses different figures in direct interviews. As a result, we primarily use documents from the FTX lawsuit discovery with sources in the footnotes.

--------

With the Binance investment at the end of 2019, FTX went into 2020 with a war chest larger than most other crypto exchanges.

Not enough for SBF, though, so FTX launched a new token in February of 2020: FTX_EQUITY.

For the price of $2 per token, investors could own a piece of FTX Trading LTD, the Antigua company that owned the FTX trading platform. Although the FTX_EQUITY corresponded with an $1 billion valuation for FTX and the minimum purchase size of FTX_EQUITY was $250,000, investors quickly snapped up $15 million worth of FTX_EQUITY. [0]

Just 9 months after incorporation, SBF’s crypto upstart was worth over $1 billion and had raised $93 million in equity capital. This was one of the fastest company valuation growth rates ever.

But, being the new kid on the block, they had less volume and fewer traders compared to the established exchanges – although that would quickly change.

TRUMP or NO TRUMP?

SBF had considered venturing into politics before starting Alameda. The 2020 election cycle gave him the perfect chance to marry this long-standing interest with his new and rapidly growing crypto exchange.

In February 2020, FTX launched presidential tokens. These tokens promised to pay a $1 reward per token if their corresponding candidate won the election. Otherwise, they’d expire worthless.

FTX users could purchase tokens for TRUMP, BERNIE, BLOOMBERG, PETE, WARREN, or BIDEN at fractions of a dollar, usually less than 50 cents, and gamble on the results of the election. Better yet, FTX traders could use margin for these purchase with a baseline capital of anywhere from $0.05 to $0.25 per token.[1]

This was the perfect product for a crypto exchange. It showcased the exotic bets and lack of regulation that crypto could offer, further adding to FTX’s notoriety. By the end of the election on November 3rd, around 200 million presidential tokens had been traded through the exchange.

But as we know, this last election was a messy affair. After days of vote count uncertainty, Biden was announced as the next POTUS, but with most Trump supporters believing the election was stolen. For many, there was still the hope that Trump would emerge victorious in the coming months before the transition of power to Biden.

The contested presidency placed FTX in an awkward position. Many users pointed to the unrest as an indication that their Trump tokens had some value and that FTX should delay payouts until February 2021.

After angry back and forth on Twitter, SBF decided that FTX would execute all presidential token payouts in late November 2022. FTX then transitioned TRUMP tokens to a new, TRUMPFEBWIN token, that would pay out in the event of a Trump victory by February.

This wouldn't be the last of SBF’s political ambitions.

FTX.US

Even though FTX was founded by a team of US citizens and backed by US investors, FTX was barred from accepting US customers onto their platform due to US financial regulations.

That is, until May 2020, when SBF launched FTX.US, a self-contained trading platform for US traders and a distinct entity from FTX Trading LTD. Because of FTX’s success, FTX.US had a big leg up by attracting a heavy-weight cast. The team appointed Brett Harrison as President for FTX.US, a former Head of Trading Systems Technology at Jane Street. Brett was joined by Sina Nader, previously Head of Crypto at Robinhood. [2]

Together, the FTX.US team registered as a Money Services Business (MSB) and obtained Money Transmitter Licenses (MTL) in 49 out of 50 states. The only state missing was New York State. Further, deposits on FTX.US claimed to be FDIC insured (they were not FDIC insured on FTX international).

At launch, the FTX.US offerings were quite sparse. They offered spot trading in six coins only – Bitcoin (BTC), Ether (ETH), Bitcoin Cash (BCH), Litecoin (LTC), Paxos gold (PAXG) token and Tether (USDT) stablecoin.

FTX.US traders were only able to play with 10x leverage while paying 0.2% to 0.4% in fees as compared to the 101x leverage and 0.005% to 0.07% fees found on FTX international. And, FTX.US kept a different order book than FTX International. This meant that the FTX.US team had to build the exchange from scratch. They couldn’t divert the FTX international traders to transact with US traders.

Despite the challenges, the FTX.US launch was a step forward for SBF and his team towards their final vision. Just one month after founding, FTX.US acquired Embed Financial Technologies, who specialized in embedding investing into any product. It was clear they were willing to invest heavy capital to ensure FTX.US’s success.

“I think U.S. crypto customers have been under-served for a while, and I'm excited to try to push the industry forward.” - SBF

Serum, Leveraged Assets

In July 2020, FTX launched Serum, a decentralized exchange built on top of Solana.

With the launch, SBF posted five separate tweet threads on the state of DeFi and his vision for Serum. Antoly, cofounder of Solana, also personally endorsed the new exchange and wrote a lengthy blog post on why Serum was a big deal for Solana. [3]

With FTX’s learnings from launching FTT, SBF refined the process for Serum. This time, investors were invited to purchase SRM ahead of the launch – the only caveat being that they had to act fast. Late investors paid 50% more for committing capital just a few hours later than earlier counterparts. [4]

It worked. The $SRM token listed on all the major exchanges at launch, including Binance, Kucoin, Kraken, Uniswap, and FTX. Compared with the FTT launch, which debuted on only three minor exchanges, FTX had come far in just a year.

While the Serum exchange itself didn’t see much traction, the SRM token surged 1,636% from an $0.11 listing price to over $1.80 just 12 hours after listing. In terms of price, Serum’s launch was one of the most successful of all time.

However, there were two concerns surrounding the new token.

First, no one knew who Serum’s developers were. SBF had been the one promoting the exchange and token, but it wasn’t clear who exactly was working on the project. Was FTX’s core team splitting time between FTX and Serum? Or was Serum a new company with separate team members?

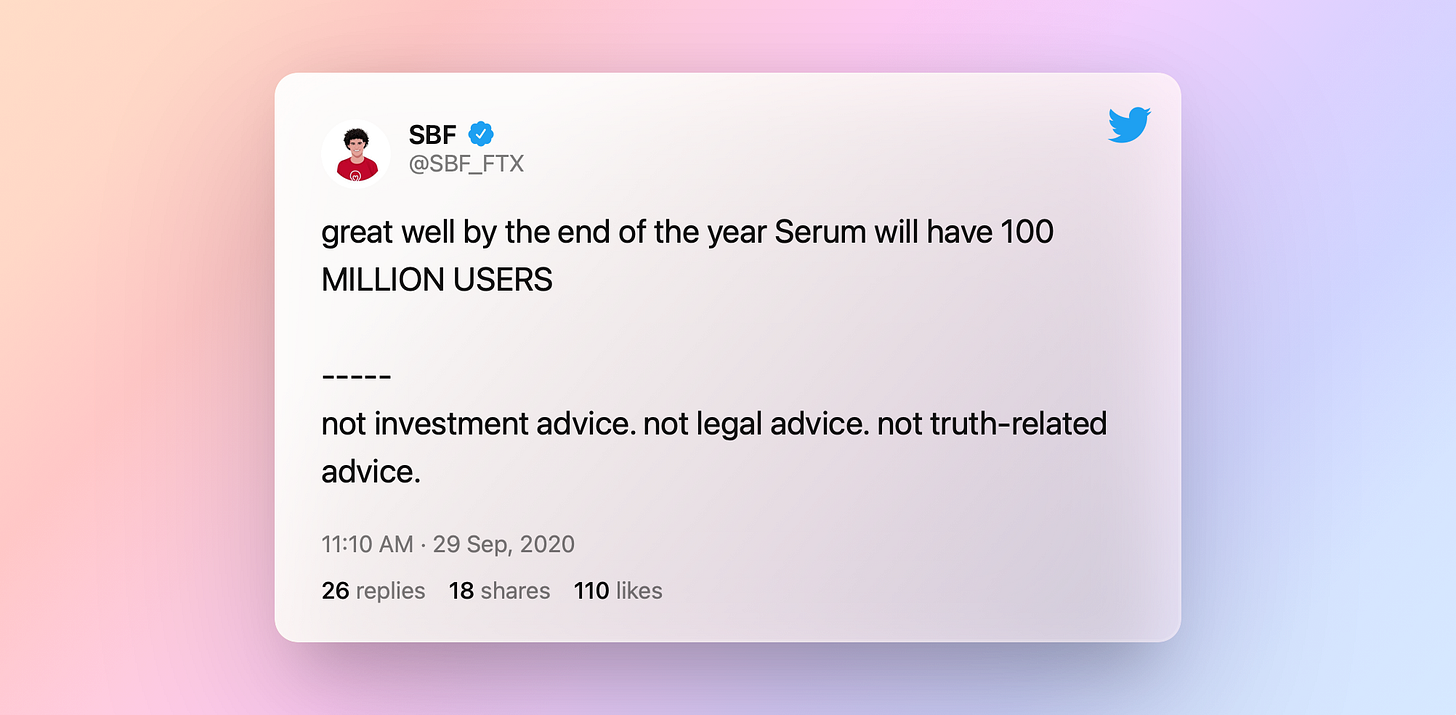

In the end, most of Serum’s communication stemmed directly from SBF. Notably, he published a blog post asking, “could Serum become a trillion dollar ecosystem with a billion users?” [5] (spoiler: it wouldn’t).

Second, and more troubling: only 160 million of 10 billion SRM tokens went into circulation at launch. In other words, 98.4% of SRM tokens were held by the Serum team, which seemed to consist of SBF only.

The Serum launch only sold $10-$15 million worth of tokens. Certainly nothing to sneeze at, but far from groundbreaking for FTX.

The real play? “Assets” for FTX.

With just a few months of engineering time and marketing efforts, the team had produced nearly $18 billion worth of assets for FTX / Alameda. At a $1.80 token price and 10 billion total tokens, the total market cap for SRM was $18 billion. Of this $18 billion, $17.352 billion sat on FTX/Alameda’s balance sheets.

While they couldn’t withdraw any of this as cash, they could use it to prop up their finances to look strong while raising more capital, or borrow against it.

By September 2020, SBF was gloating.

Blockfolio, FTX’s CoinMarketCap

Despite FTX’s string of successes, Binance still managed to steal the headline for 2020. They dropped more than $400 million that April to acquire CoinMarketCap, one of the most popular crypto market data websites.

At the time, CoinMarketCap was the 570th most visited website. As someone who ran a website in the top 1,000 globally, being 570th meant 120-150 million page views monthly. Binance was at rank 1,688.

Referring to the deal, CZ said, “CoinMarketCap has more users than any other product in the crypto space. Even though their money generation mechanism is not as strong as Binance, they do have the users – it’s a very valuable platform.” [6]

In August 2020, FTX ran the exact same play to acquire Blockfolio for $150 million in cash, cryptocurrency, and stock.

Like CoinMarketCap, Blockfolio’s core product was tracking crypto prices and portfolio holdings. Founded back in 2014, Blockfolio’s iPhone and Android app garnered a cumulative 6.5-7 million downloads. By December 2019, they had 821,000 monthly active users. [7]

Objectively, this wasn’t as juicy of a deal as CoinMarketCap. The latter had more unique users, proprietary data flow, and an established brand image. Nonetheless, Blockfolio was an extremely attractive property for several reasons:

First, Blockfolio’s 1 million active users were really, truly active. In an interview, Blockfolio shared higher page view numbers than CoinMarketCap. Blockfolio CEO’s commented, “Given how much people refresh our app, I guess it’s not just the size of the boat; it’s the motion of the ocean that counts.” [8]

Second, the majority of Blockfolio’s user base was in the US and Europe. Reporting from The Generalist quotes, “The US is the company’s biggest stronghold, contributing 18%. The Netherlands (6.41%), United Kingdom (5.96%), Germany (5.74%), and Russia (3.74%) complete the top five.”

The acquisition meant all of these users were instantly added to FTX.US’s user base.

From a customer acquisition lens, FTX spent just $23 per user on customer acquisition cost. In SBF’s own words, “It’s an ‘acquire for the synergy and scale up’ sort of deal.”

At the time, FTX only had 30,000 users. Blockfolio’s additional 821,000 was an astonishing 27x increase.

Another weapon in the Blockfolio arsenal was its mobile traffic. While CoinMarketCap had a huge web presence with little mobile traffic, Blockfolio was the inverse. FTX purchasing Blockfolio was a bet on this new trend. [9]

“More and more of the world is not just going online, but mobile. There is a lot of evidence that there is a huge demand for this type of product if it’s done right. It’s a wide open field.” - SBF

Reckless Greed at Alameda

Let’s briefly catch up on Alameda Research.

FTX’s growth granted Alameda a significant edge over their trading competitors. Publicly, Alameda used their name on the Bitmex trading leaderboards – showing that they were one of the top trading firms in the world by profit.

They had finished 2019 with confirmed profits of at least BTC 6,941 (USD 60 million) and daily volumes of around $1 billion, roughly 5% of the total crypto volume worldwide.

Back in March 2019, a key figure had joined Alameda as a trader – one Sam Trabucco. Like many of FTX’s hires, Trabucco shared ties with SBF running back to a five-week math camp at Mount Holyoke College in 2010. They crossed paths again at MIT.

Trabucco previously worked as a quantitative trader at Susquehanna International Group (SIG), trading bond ETFs and working on their sports betting desk. A natural gel with SBF’s risk-taking framework, he pushed Alameda to take on higher risk.

When Alameda was first founded, it sold its formula as a “market-neutral approach, quoting buy and sell prices for thousands of products and earning the difference when customers trade both sides.”

But by 2020, Alameda had adopted a strategy of highly leveraged, directional betting. In fact, Alameda built large positions in DOGE heavily based on Elon Musk’s tweets.

It reads like satire. And yet, Alameda, a team of the world’s smartest people, were trading based on how one eccentric billionaire was tweeting. Trabucco was 100% serious.

In another interview published on the FTX blog, Trabucco elaborated on how FTX was ingesting market news: “Our traders will tend to watch Twitter and other social media from time to time to make sure nothing big has happened. We also have a slack channel called #urgent-trade-news which we encourage anyone at the company to quickly post if they see literally anything which they think could have market impact…”

Not exactly the most sophisticated trading engine. In the same interview, Trabucco claimed, “my biggest relative edge… is the intuition I’ve developed for the ways the market works. It’s hard to make explicit, but playing this game for a while has given me advantages moving forward and playing it…”

So, in other words, traders were basically scrolling through Twitter and making trades based on gut feeling. This was quite a far leap from their prior algorithmic market-neutral strategy.

Trabucco shouted his strategy from the rooftops. In the same Twitter thread as the DOGE tweet:

“Are we the only ones with 24/7 coverage? Nope, but we're among the few.

Are we the only ones who understand all this? Nope, but we're among the few.

Are we the only ones with a ton of capital? Nope, but we're among the few.

Are we the only ones with all 3?.........Maybe?

And so we've slowly realized -- our ability to make good delta bets is like another super power, and it's one with a lot of $ on the table.

So we've embraced it, and we make BIG bets.”

It wasn’t just Trabucco. Caroline Ellison’s tweets were just as egregious. Here’s one where she talks about making “balls long” bets:

Rewarded for their bet-making abilities, Caroline and Trabucco found themselves co-CEO’s of Alameda in October 2021.

Alameda wasn’t limiting itself solely to directional bets, either. They also started front-running new tokens being listed on FTX, calling dibs before anyone else could purchase them. They bought a combined estimate of $60 million worth of tokens across 18 listings, all tied to the Ethereum blockchain. [10]

“What we see is they’ve basically almost always in the month leading up to it bought into a position that they previously didn’t. It’s quite clear there's something in the market telling them they should be buying things they previously hadn’t,” said Omar Amjad, co-founder of Argus.

It seemed like FTX and Alameda were on a never-ending winning streak…

[0] FTX_EQUITY is one of the stranger ways to perform a venture round. So strange that most data platforms like Crunchbase didn’t record this raise.

[1] FTX’s support article on the presidential tokens

[2] On Sina’s LinkedIn, it shows that he’s the Head of Partnerships at FTX.US but in an external blog post, he’s the COO of FTX.US.

[3] In Antoly’s own words, “Serum is a complete, non-custodial spot and derivatives exchange running on an on-chain central limit order book (CLOB) on Solana’s mainnet. Yep, you read that right.”

[4] Jason’s Twitter thread is one of the best on the financial tinkerings of FTX

[5] SBF’s Serum blog post is his classic, “make big claims and sound smart”, style of writing.

[6] CZ’s relationship with the founder of CoinMarketCap is somewhat touched on in this Coindesk article about the acquisition

[7] From data gathered by The Generalist

[8] Edward Moncada was previously a professional poker player before founding Blockfolio in 2014 and boasting against CoinMarketCap.

[9] Generally speaking, SBF was right on the money with mobile and crypto. Robinhood would see massive adoption from their crypto products due to the mobile-first nature of the company.

[10] Reporting on Alameda front-running tokens came out after the collapse of FTX.