Ann Miura-Ko on Floodgates's Thunder Lizard Theory and Achieving Product Market Fit

Hey, Nick here! In this newsletter, I curate insights and timeless principles on how to build great products. You’ll improve your product skills with every issue.

Here’s a video for you today…

Ann Miura-Ko on Floodgates's Thunder Lizard Theory and Achieving Product Market Fit

Ann Miura-Ko holds a PhD from Stanford in math modeling of infosec and is a co-founder of the VC firm, Floodgate. She was an early investor in Lyft where she saw her investment grow 10,000x. She has been consistently named on Forbes “Midas Seed” list and was also called “the most powerful woman in startups.”

Since she focuses on seed round investments, it’s very important for her to identify winning products and teams before their products are fully realized.

Here are 4 insights on how she is able to identify those companies and products.

The Thunder Lizard Theory

A “Thunder Lizard” is an animal that is inspired by Godzilla. They are a mythical creature that wreaks havoc wherever they go. When looking at investment opportunities, she looks for entrepreneurs that have similar qualities to a Thunder Lizard.

She lists out the 4 qualities that a Thunder Lizard entrepreneur has:

Converts advantages to disruptive power

Minimized technical and organizational debt

Achieves product market fit

Avoid competition

Thunder Lizards are very rare and few people can be labeled as one. It’s saved for the most exceptional entrepreneurs.

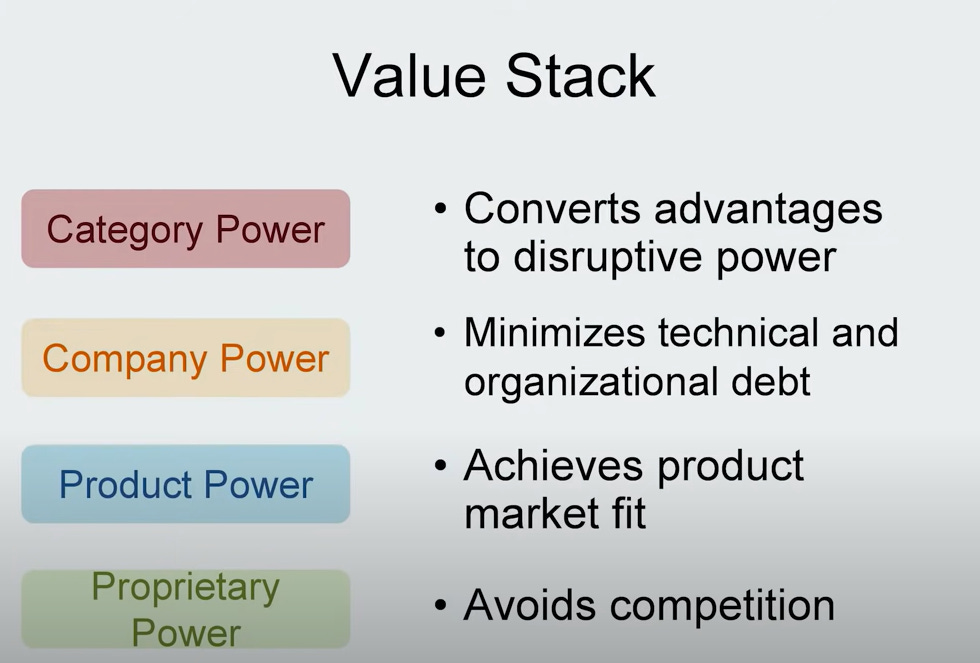

The Value Stack of Sustained Businesses

Floodgate is an early-stage fund, so they need to know what to spot successful companies from the start. Ann developed a “Value Stack” framework to help her identify worthwhile investments. There are 4 components that build on themselves to create a sustained business.

Proprietary Power

She initially called this “Technology Power.” This is the foundation where a company is built. It can stem from many different avenues, but this is where a company builds a moat. Whether it’s proprietary IP or high switching costs, a customer is hooked. There has to be something special and unique about the technology which enables services to be provided to customers.

Product Power

Even if there is exceptional proprietary IP for the technology, that doesn’t mean there is product market fit. Ann talks about specific moments where a person truly sees the potential of the product. She referenced the Democratic National Convention for Airbnb and the first few weekends when Lyft started to offer rides. There was a specific excitement and buzz which isn’t easily replicated.

Company Power

This is when there is a sustained company that can support the technology and product market fit. This includes items like systems and processes on how to complete work all the way up to the company's mission and vision. There is an entity that enables the product and for it to be sold to clients.

Category Power

Just like having a Thunder Lizard entrepreneur is rare, creating a category is also extremely difficult. Transcendent companies and products are able to do this. Netflix didn’t compete with Blockbuster, they created a new category, streaming, that took down Blockbuster. There were questions about why people would pay for expensive Starbucks coffee when there are so many cheaper options, but Starbucks was able to keep people coming back for a high-end experience. They created something new.

Early Signs of a Successful Company

The number one thing that’s important for her in early-stage investing is the speed at which decisions are made. The first sign of distress is when founders are frozen when making decisions.

She also likes to see a clear story of why the founders are best positioned to solve a problem. Did they have a list of 20 different ideas and it just so happened they chose this one or have they been deeply impacted by the problem they are solving? Typically, those who have an intimate connection have a better chance of success since they are less likely to give up.

Ideal Startup Team

To her, the ideal size of a founding team is between 2-3 people. It can work up to 5 people, but that’s the tipping point of having too many people. Startups need to be nimble and more people create inertia.

Being a solo founder is very lonely and you are a prisoner to the startup. Having a team allows for stress to be distributed. In addition, a team can play off each other's strengths giving a better chance for the startup’s success.

You can find a link to the full interviewer here.

End Note

Thank you for reading!

For bite-sized product tips in your Twitter feed, follow @ProductPersonHQ.

Have a great day,

Nick